Jindal Poly Films (NSE:JINDALPOLY)

Value Packaged?

CMP: 880.2

It’s been another busy week. I’ve deployed the remaining cash and entered into 3 new positions that I believe are currently trading at great value. I’ll try to write about each between now and the weekend.

Riding the FMCG wave without the overvaluations.

What do most FMCG businesses have in common? They need packaging.

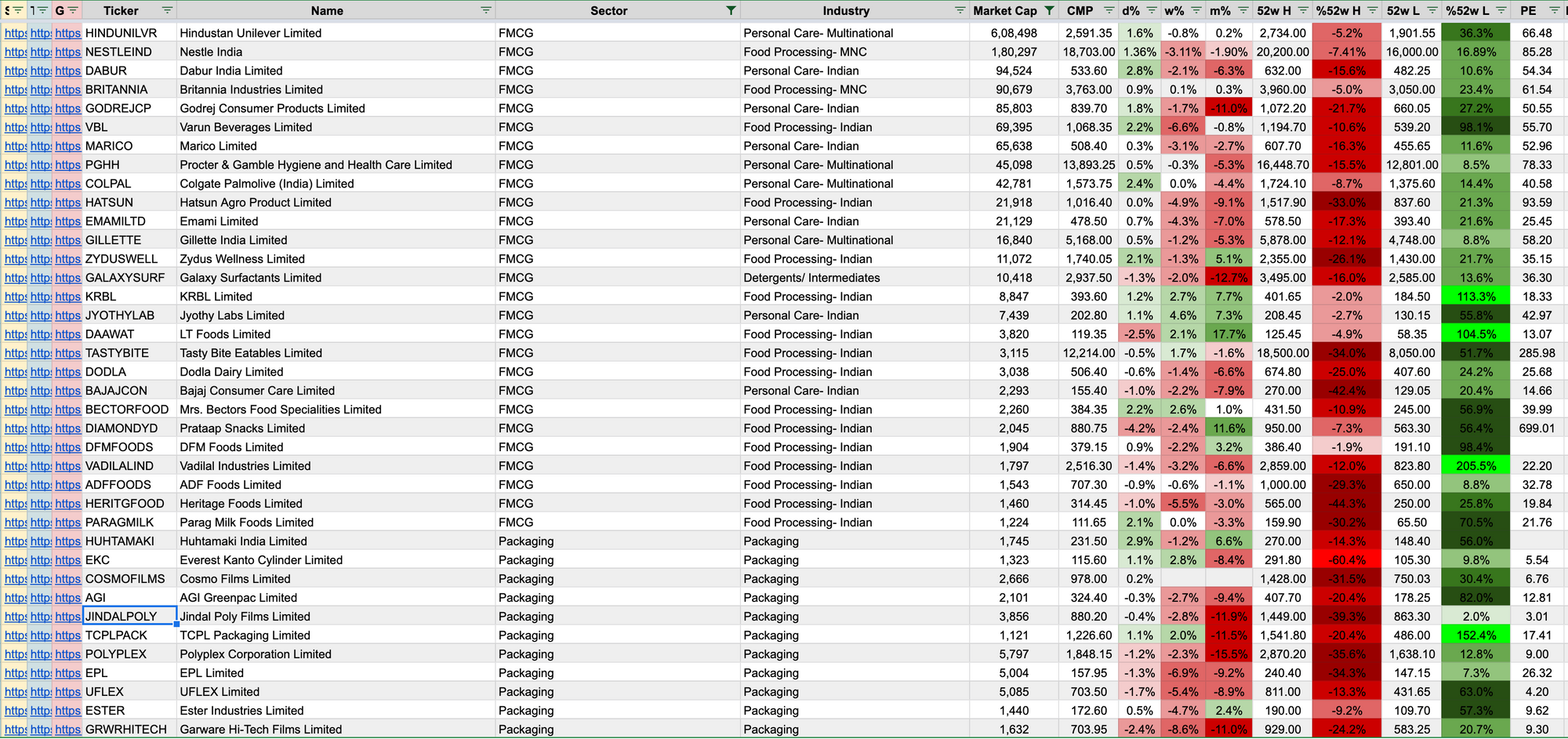

Many players in the packaging sector cater to the FMCG space and have had their revenues rise alongside the FMCG players, yet they do not enjoy the same investor bullishness. While FMCG stocks have performed well recently with many trading at or near then 52 week high, most packaging stocks have significantly corrected from their 52 week high. Why the discrepancy? I believe it’s an overlooked sector maybe due to the fact that most all stocks are small caps trading in the region of 5000cr or less. It is often in overlooked sectors that one might find value.

The packaging sector seems to offer all the benefits of the FMCG sector, without the overvaluations. Even within the sector, some trade extremely cheap relative to value. One such company is Jindal Poly Films. I bought shares on Monday (10.10.2022) at 890/share.

About the Company.

Jindal Poly Films (JPFL) is engaged in the production and sale of packaging films. The company manufactures BOPP, BOPET, Metalized, Coated and Thermal films as well as non-woven fabrics. BOPP and BOPET films are extensively used for food packaging as they ensure extended shelf-life, product protection and appeal. JPFL is the largest manufacturer of BOPET and BOPP films in India and expects to maintain its leadership position over the medium term. Its manufacturing facility in Maharashtra is the world’s largest facility at a single location for the production of BOPP and BOPET films.

Packaging accounted for around 90% of revenues, the remaining 10% came from non-woven fabric in FY22. The company generated 66% of revenues domestically, rest coming from international sales. The company has a strong global customer base, yet no single customer contributes more than 10% of revenues in the respective segments.

Financials and Ratios.

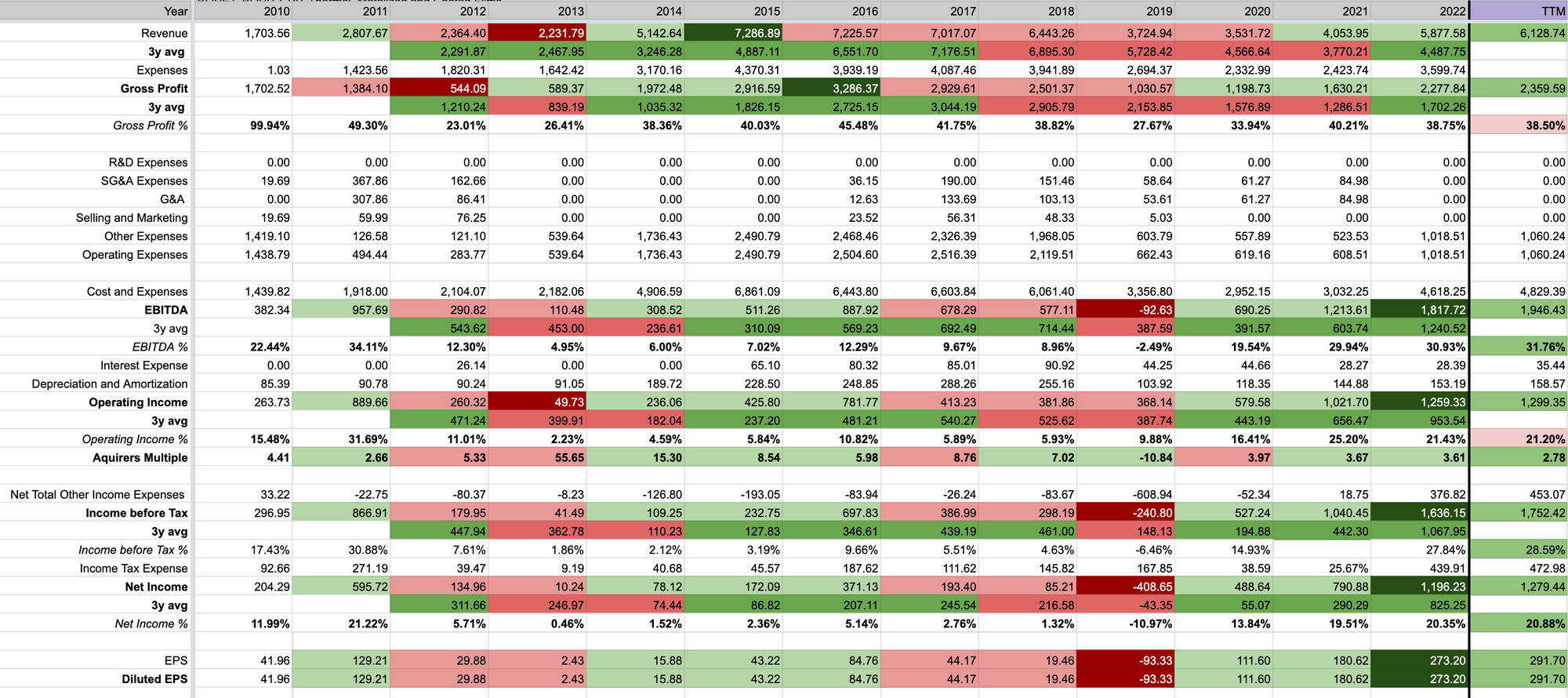

JPFLs FY22 3 year average revenues stood at 4500cr (standalone FY22 revenues were 5900cr). This is a far cry from its peak 3 year average revenues of 7000cr for the period ending FY2017. Revenues have been showing recovery, rising from a low of 3500cr for FY20 to TTM revenues of 6000cr. Even a return to its historical average revenues of 7000+ cr should positively impact the company and its stock price.

Despite the fall in revenues from peak and ignoring the rise back to those levels, the general trend of 3 year average EBITDA, operating and net income has been to the up as a result of higher margins due to economies of scale. Operating margins during periods of peak revenues were in the single digits which have grown to 20% in the last 3 years.

FY22 was the companies highest period of earnings (EBITDA, operating, PAT) and these numbers look even better on a TTM basis.

The company has debt of 1200cr (30% debt/equity), mostly in the form of foreign loans. These will be more costly to service but the company has cash and a respectable current ratio and interest conversation of 2.07 and 36.7 respectively. The company has a long history of using debt to fund Capex and this has never been an issue.

At CMP, the company goes for just 0.6x sales and trades at a P/B of 1 and P/E of just 3 (5 year average 4.5). Since P/E only looks at the equity side and doesn’t account for debt, the EV/EBIT is a far better metric to use. JPFL goes for an EV/EBIT of just 2.8.

Recent Developments

Two key developments in the past year are important to take note of.