Cineline India (NSE:CINELINE)

Since my last post in November, I have exited 7 stocks - Rajesh Exports, Sandesh, Ambika Cotton, Everest Kanto, Jindal Polymers, Maithan Alloys and Geojit Financial Services. I have entered one new investment, at a price of ₹125/share, which I am writing about today.

Date: 17 June, 2024. CMP: ₹131/share. Market Cap: ₹456cr.

Disc. : Not a recommendation.

My latest investment, now the largest position in my portfolio, is a micro-cap company that has failed to turn a profit in the last 3 years, carries significant debt, and competes against a giant in its industry. Despite these challenges, I see a compelling investment opportunity. Here's why:

The Company: Cineline

Cineline is in the business of building, owning, and operating multiplexes, theatres, and entertainment centres. Since 2022, it has operated a chain of multiplexes under the brand name ‘Moviemax’ and is currently the fourth-largest player in the Indian movie exhibition space.

Company History

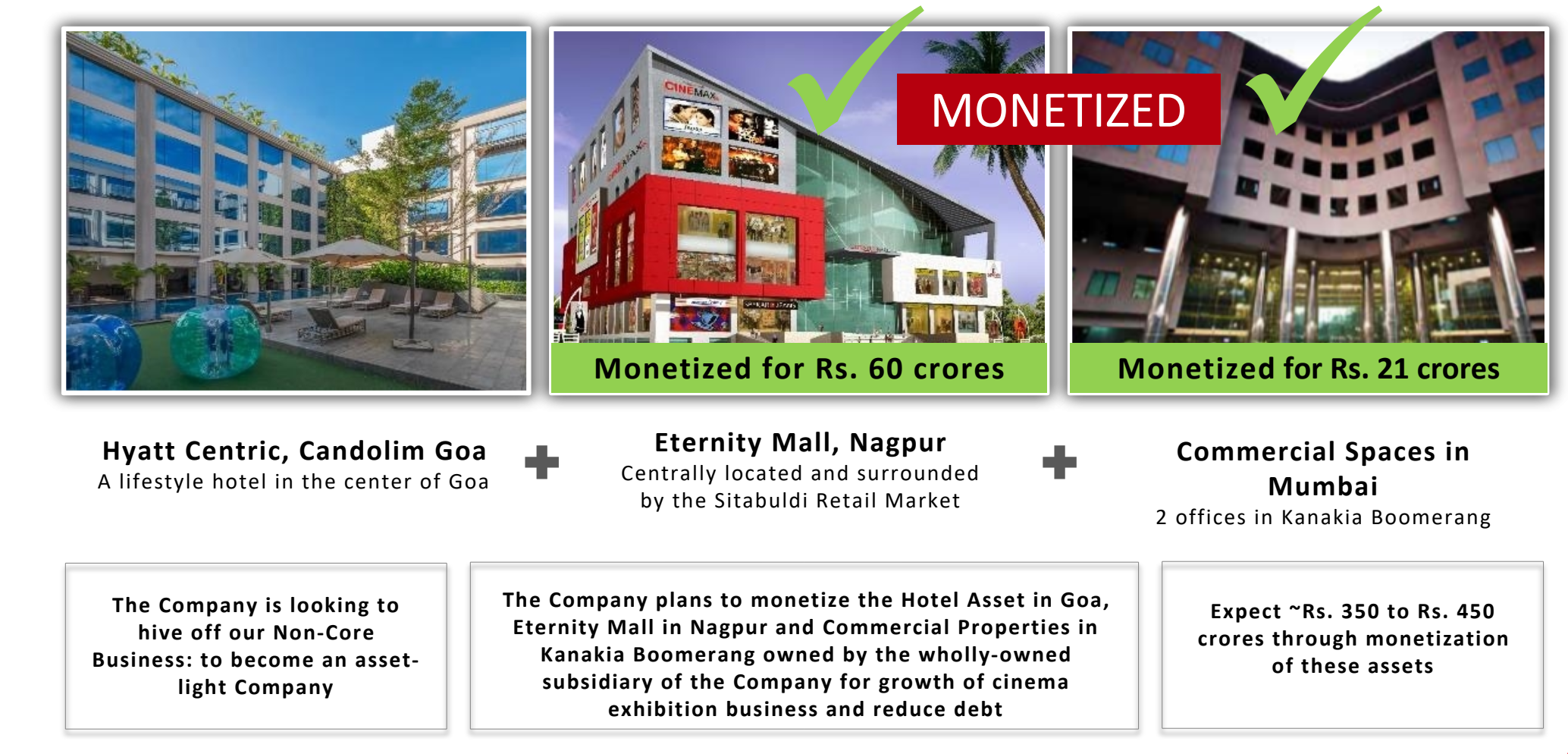

Though it appears to be a recent entrant into the film exhibition space dominated by PVR-INOX, Cineline was actually one of the earliest players in India's multiplex business. Originally operating under the brand ‘Cinemax’, the company operated 138 screens across several cities. In 2012, it sold the entire operation to PVR and simultaneously entered into a 10 year non-compete clause. During this period, the company shifted to the lease rental business, generating stable income from leasing properties including malls, commercial units, cinemas, and a hotel. With the expiry of the non-compete clause in 2022, Cineline re-entered the movie exhibition business under the new brand ‘Moviemax’.

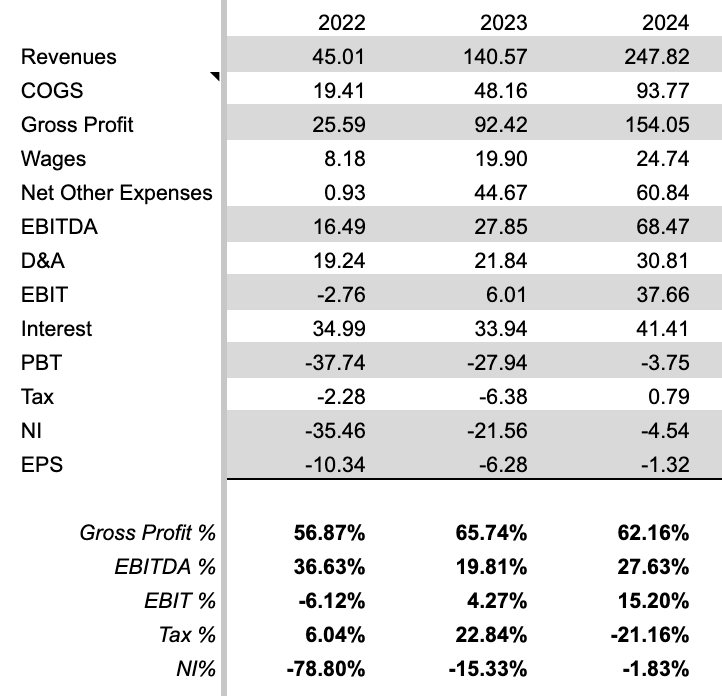

Since its re-launch under Moviemax in 2022, Cineline has not yet achieved net profitability. However, a closer look at its financials reveals a clear path to profitability driven by growing revenues, improving operating profitability, and a restructuring of its balance sheet through asset sales.

Revenue Growth

Re-entering the film exhibition business significantly boosted Cineline's top-line. In its first full year of operations under Moviemax (FY23), revenues grew by 212% to ₹140 crore, and in FY24, they grew a further 76% to nearly ₹250 crore as a result of rapid expansion and introduction of new cinemas and screens across the country. This growth is impressive, especially considering that the majority of screens owned by the company are yet become operational. Of the 167 screens the company presently owns, only 76 are operational with a further 91 to soon be operational. The company plans to expand to over 300 screens in the coming years, suggesting continued revenue growth.

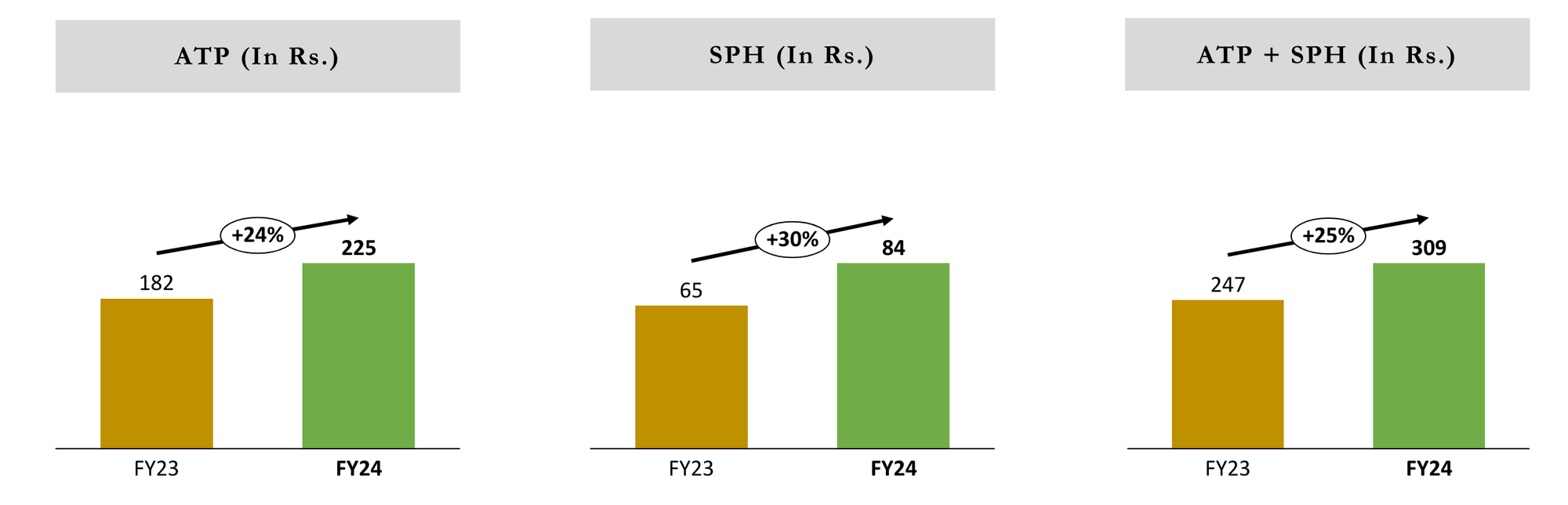

Crucially, growth in revenues isn’t coming solely from the addition of new screens. The company has also been able to eke out more money per visit from customers. Here, two metrics come into play: Average Ticker Price (ATP) and Spend Per Head (SPH). ATP is self-explanatory and tends to fluctuate based on a number of factors. Since its launch, Cineline’s ATP has increased from ₹180 to over ₹200. However, since Cineline offers a more budget friendly alternative to multiplex chains such as PVR-INOX, there isn’t much room for growth in ATP beyond a certain point.

For Cineline, SPH - the average amount spent by each customer buying food and beverages each visit - becomes all the more important. Since launching, the company has grown SPH from under ₹60 to over ₹85 - a near 50% growth. The result is that the company has grown total average spend per customer (ATP+SPH) from ₹240 to ₹300+ in a short span of time, all while growing the total number of screens. Growth in both ‘price’ and ‘volume'- a very positive sign.

Operating Profitability

Operating profit has grown significantly. EBITDA increased from ₹27.5 crore in FY23 to ₹68.5 crore in FY24, with EBITDA margins improving from 20% to 27.5%. EBIT also turned positive, rising from ₹6 crore in FY23 to ₹38 crore in FY24, despite a nearly 50% increase in depreciation expense.

This profitability is driven by the company’s strategy of acquiring fully fitted screens that generate revenue from day one and renovating existing screens to improve margins.

Debt and Restructuring

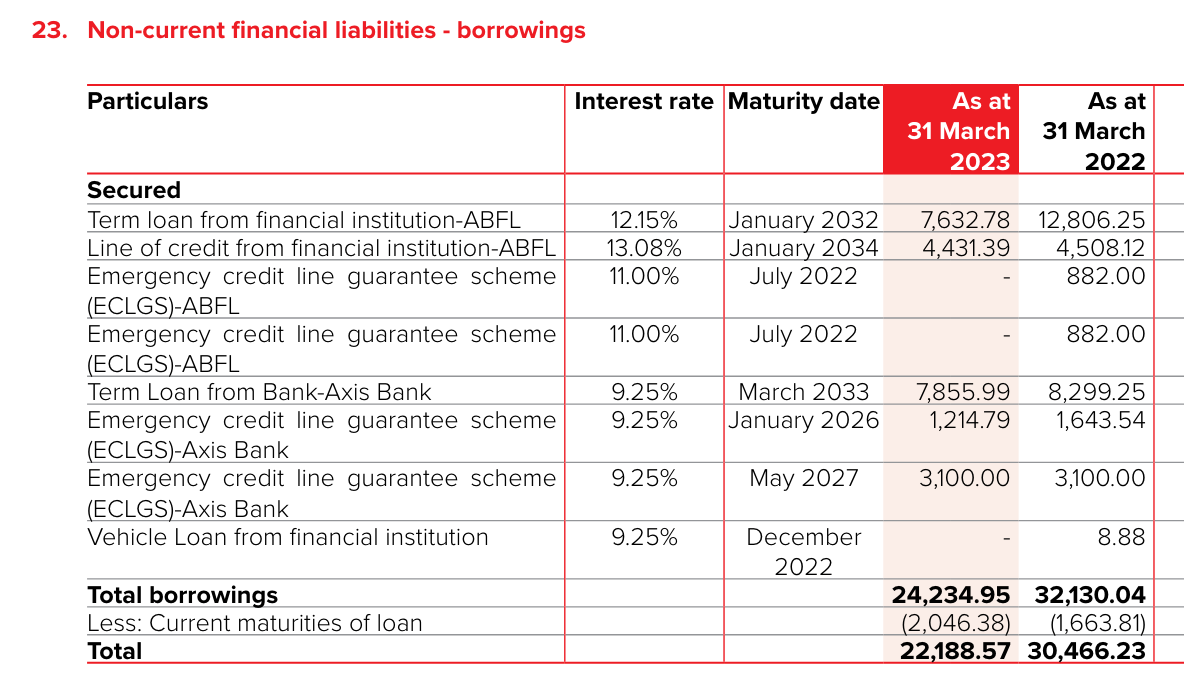

Despite these positive trends, Cineline’s net profitability has been hindered by its high levels of debt. The company has over ₹350 crore in debt and paid ₹41.5 crore in interest in FY24, resulting in a net loss of ₹4.5 crore. However, there are positive signs in the debt mix.

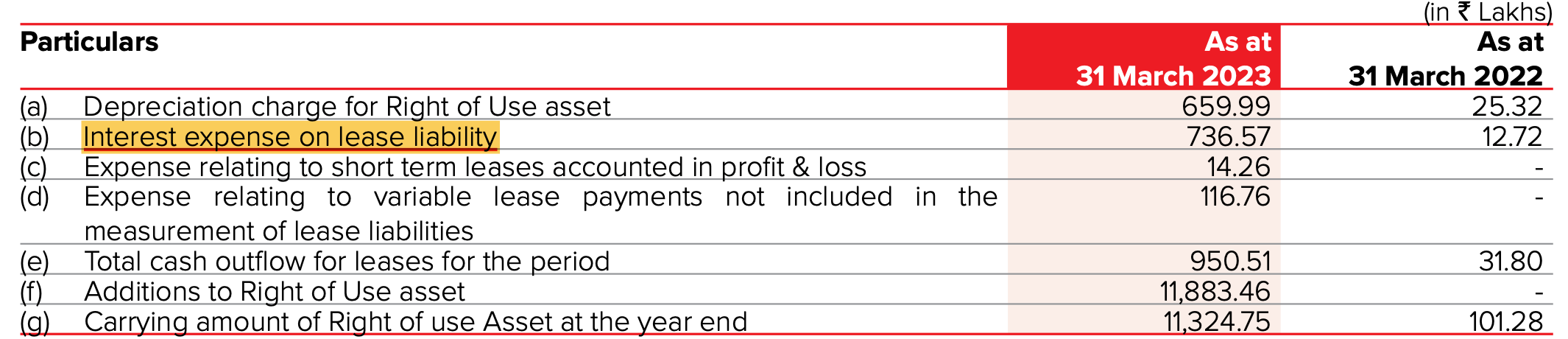

Although total debt rose, the composition shifted favourably. Long-term borrowings decreased from ₹305 crore in FY22 to ₹219 crore in FY24, while lease liabilities increased to ₹120cr. Here’s why the change in debt composition matters and is a positive sign- the lease liability allows Cineline the right to use the asset leased for a substantial portion of its useful life without needing an immediate large capital outlay. Since the company aims to expand the number of cinemas and screens that it owns, it would require lease financing to make this growth possible and will thus continue to remain a part of the company’s ongoing operations.

Further, the company in FY23 paid just ₹7.4cr in interest expense on its ₹112cr in lease liability which comes to an estimate interest rate of around 6.6% on its leases. This is significantly lower than the rates incurred on its long-term borrowings which in FY23 ranged between 9% and 13% for its various loans. This shift towards lower interest-bearing debt supports the company's growth strategy.

Catalyst: Interest Savings from the Sale of Non-Core Assets

In FY23, Cineline sold three non-core assets for ₹81 crore, using the proceeds to reduce debt from ₹322 crore to ₹242 crore. In May 2024, the board approved the sale of its remaining non-core asset, a hotel in Goa, for no less than ₹270 crore, with the sale expected by September 30, 2024. The hotel carries ₹115 crore in borrowings. Once sold, the company will reduce its borrowings by ₹115 crore and gain at least ₹155 crore in cash for further debt reduction or expansion. This should enable the company to achieve net profitability soon.

Valuation

Cineline currently trades at an 11.6x EV/EBITDA, around its lowest level since Moviemax's launch. With debt being paid down and a healthier balance sheet post-hotel sale, I anticipate it to trade at higher multiple soon. Assuming no revenue growth and a conservative EBITDA of ₹60 crore for FY25, applying a 15x EBITDA multiple (1y median EBITDA multiple was 15.4x) results in an enterprise value of ₹900 crore. The hotel sale should free up ₹155cr in cash and reduce outstanding borrowings to ₹115cr. Assuming lease liabilities growth to ₹150cr, total debt should be around ₹265cr. This gives us an equity value of ₹790cr (900 - 265 + 155) and an estimated price of ₹230 per share, suggesting substantial upside from current levels.

Conclusion

Cineline is on a clear trajectory of revenue growth and has demonstrated its ability to turn an operating profit as it scales. Despite high debt and interest expenses, the sale of non-core assets, particularly the hotel, should significantly reduce debt and interest expenses, leading to net profitability. With the stock trading at a low multiple, I believe it is presently undervalued and can double in the coming years. For these reasons, I have made Cineline the largest position in my portfolio.

Member discussion